Limited Fiscal Representation – Explanation and Process

When working with Amsterdam Warehouse Company (AWC) under a limited fiscal representation in the Netherlands, overseas companies can import and sell goods within the EU without having to establish a Dutch entity or register for Dutch VAT. AWC acts as your official fiscal representative for VAT purposes, allowing you to invoice your customers directly at a 0% VAT rate, fully compliant with Dutch and EU VAT legislation.

Main Benefits

-

No need to set up a Dutch company or obtain a local VAT registration.

-

You can invoice your EU customers directly under your own name.

-

All transactions are at 0% VAT, reducing administrative and cash-flow complexity.

-

AWC ensures full compliance with Dutch tax and customs authorities.

It is essential that the invoices AWC reviews and approves are identical to those sent to your customers.

This guarantees consistent and compliant documentation for all fiscal representation activities.

Our Working Procedure

-

Order entry

Place your order via the AWC customer portal. -

Invoice submission

Send your draft invoice to AWC for review.

You can use the provided invoice template and adjust it per shipment.

The invoice must meet all Dutch Sales Invoice Requirements (see below). -

Invoice check

AWC verifies all invoices to ensure they meet Dutch VAT and customs standards.

This control step is a fundamental part of the fiscal representation process. -

Order processing

Once the invoice is approved, AWC processes your order and provides a pre-loading list and loading reference. -

Transport and confirmation

Your carrier arranges collection using the loading reference.

You then receive the signed packing list and transport documentation.

Sales Invoice Requirements

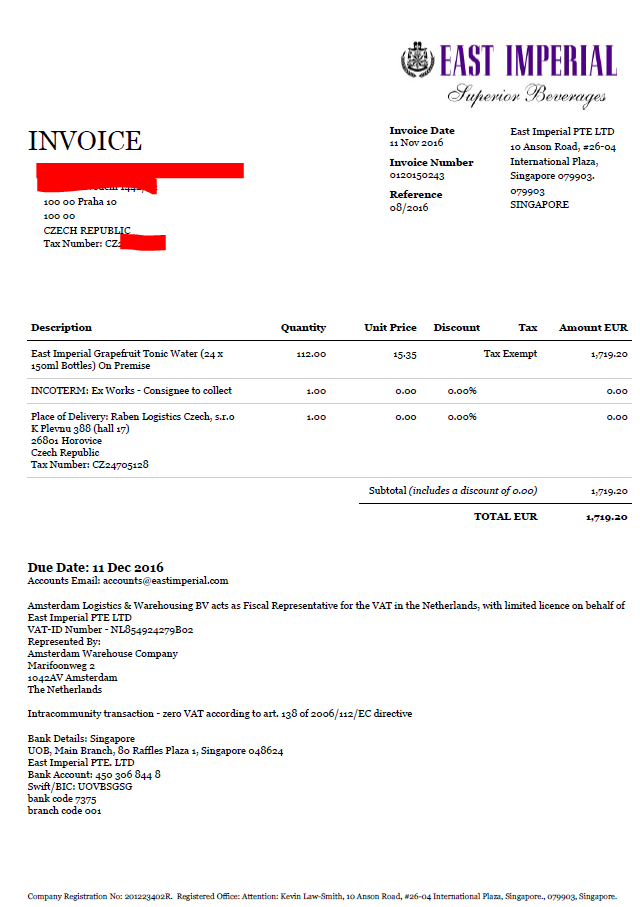

Each sales invoice must include the following block:

Amsterdam Logistics & Warehousing BV acts as Fiscal Representative for the VAT in the Netherlands, with a limited licence on behalf of [Your Company Name].

VAT-ID: NL854924279B02

Address: Amsterdam Warehouse Company, Slego 1A, 1046 BM Amsterdam, The Netherlands.

Then, depending on the shipment type, add the correct legal statement:

| Shipment Type | Invoice Text |

|---|---|

| Sales to a Dutch company | “Verlegging conform art.12 lid 3 - Wet Omzetbelasting 1968.” |

| Intra-EU sale (same delivery and invoice address) | “Intracommunity transaction – zero VAT according to art.138 of 2006/112/EC directive.” |

| Intra-EU sale (different invoice and delivery address) | “Intracommunity transaction – zero VAT according to art.138 of 2006/112/EC directive.” |

| Intra-EU triangular transaction (ABC) | “Intracommunity ABC transaction – zero VAT according to art.141 of 2006/112/EC directive.” |

| Export outside EU (e.g. Norway, Switzerland) | “Export transaction – zero VAT according to art.146 of 2006/112/EC directive.” |

Example Invoice

For shipments under limited fiscal representation, use the AWC-provided invoice template.

For more information about uploading invoices and order handling, see Invoice requirements for outgoing orders.

Need help?

Our team is ready to assist with your first setup or review of invoices under fiscal representation.

Contact us at order@amsterdamwarehouse.com for guidance.