Invoice requirements outgoing orders

When placing an order via the portal, you must upload a sales invoice that meets our requirements. This is mandatory. If you use our fiscal representation service, the order process requires additional information.

Step-by-Step Procedure

-

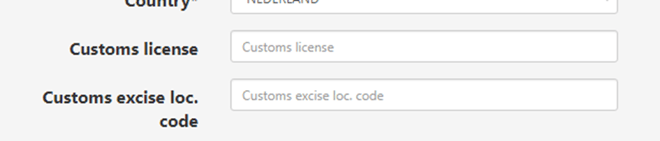

Place your order in the portal. And make sure all excise numbers are filled in. These are required for shipments to bonded warehouses or to another EU country.

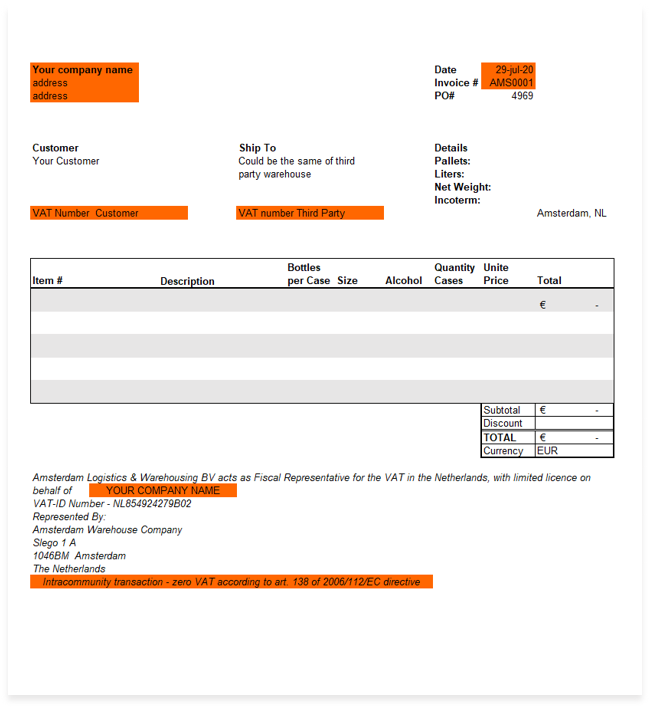

- Upload your sales invoice. For Dutch customers, you must also email the invoice to Amsterdam Warehouse Company. See the example below for required details.

- Invoice check. We verify whether your invoice meets all requirements. If correct, the order will be processed. The last sentence is an example and you need to select with every order the right one from the options below:

Shipment Type

Invoice Text

Sales to a Dutch company

“Verlegging conform art.12 lid 3 - Wet Omzetbelasting 1968.”

Intra-EU sale (same delivery and invoice address)

“Intracommunity transaction – zero VAT according to art.138 of 2006/112/EC directive.”

Intra-EU sale (different invoice and delivery address)

“Intracommunity transaction – zero VAT according to art.138 of 2006/112/EC directive.”

Intra-EU triangular transaction (ABC)

“Intracommunity ABC transaction – zero VAT according to art.141 of 2006/112/EC directive.”

Export outside EU (e.g. Norway, Switzerland)

“Export transaction – zero VAT according to art.146 of 2006/112/EC directive.”

- If the invoice is correct, we will process the order.

- Once processed, you will receive a pre-loading list containing:

✔ Estimated number of pallets

✔ Weight of the shipment

✔ Loading reference

If you make use of our fiscal representation service, also read Limited Fiscal Representation – Explanation and Process for compliance and background information.

Your opinion is important to us! We consistently aim to offer you the most valuable information. Would you be so kind to answer the question below?